Capital Campaigns and Endowment Fundraising: Does It Work?

My heart always sinks when an executive director tells me that they want to plan an endowment campaign to raise enough money so that they don’t have to raise money ever again.

It’s just wrong-headed.

Why? We’ll take a look and lay out our alternative recommendations. Here’s what we’ll cover:

- Why an endowment campaign is not the right choice

- Endowment basics: True vs. quasi-endowment

- The best way to raise funds for your endowment

- Endowment fundraising and capital campaigns

- Understanding planned giving for capital campaigns

Want expert input on your capital campaign plan? Request a free strategy session to speak with an expert today.

Why an Endowment Campaign is Not the Right Choice

Growing your nonprofit’s endowment sounds like a no-brainer that will cushion and safeguard your work for years to come. So what’s the problem?

An endowment campaign does not replace fundraising.

First of all, the fundraising process keeps organizations in touch with the people who believe in their cause. And that keeps them honest! I don’t mean that they are dishonest… but that when they aren’t accountable in a regular way to the people who care, they lose touch with why their work matters.

Without the need to make their case for support and invite donors to contribute, they become insular and disconnected. Not only is fundraising good because it brings in money, but it’s also good because it keeps organizations building relationships with the people who care.

On Keeping in Touch with Donors

If you’re reading carefully, you might be wondering about lack of communication with donors who make multi-year pledges. You should be in regular touch with donors who make multi-year pledges. It’s not a time to “sit back and relax” because they are “locked-in.” You want to take the opportunity between solicitations to cultivate and steward multi-year donors to ensure they make another gift at the end of their pledge period.

Secondly, endowment funds are very difficult to raise. Most people don’t want to take money from their investment accounts and put them in the investment accounts of nonprofit organizations. They’d rather give year after year.

That said, if your organization has been around for a while and is likely to be around for the foreseeable future, you probably should have an endowment fund… or a fund that’s treated as though it was endowment (aka, quasi-endowment).

The number one way to grow your endowment is through bequests. More on that in a moment.

Endowment Basics: True vs. quasi-endowment

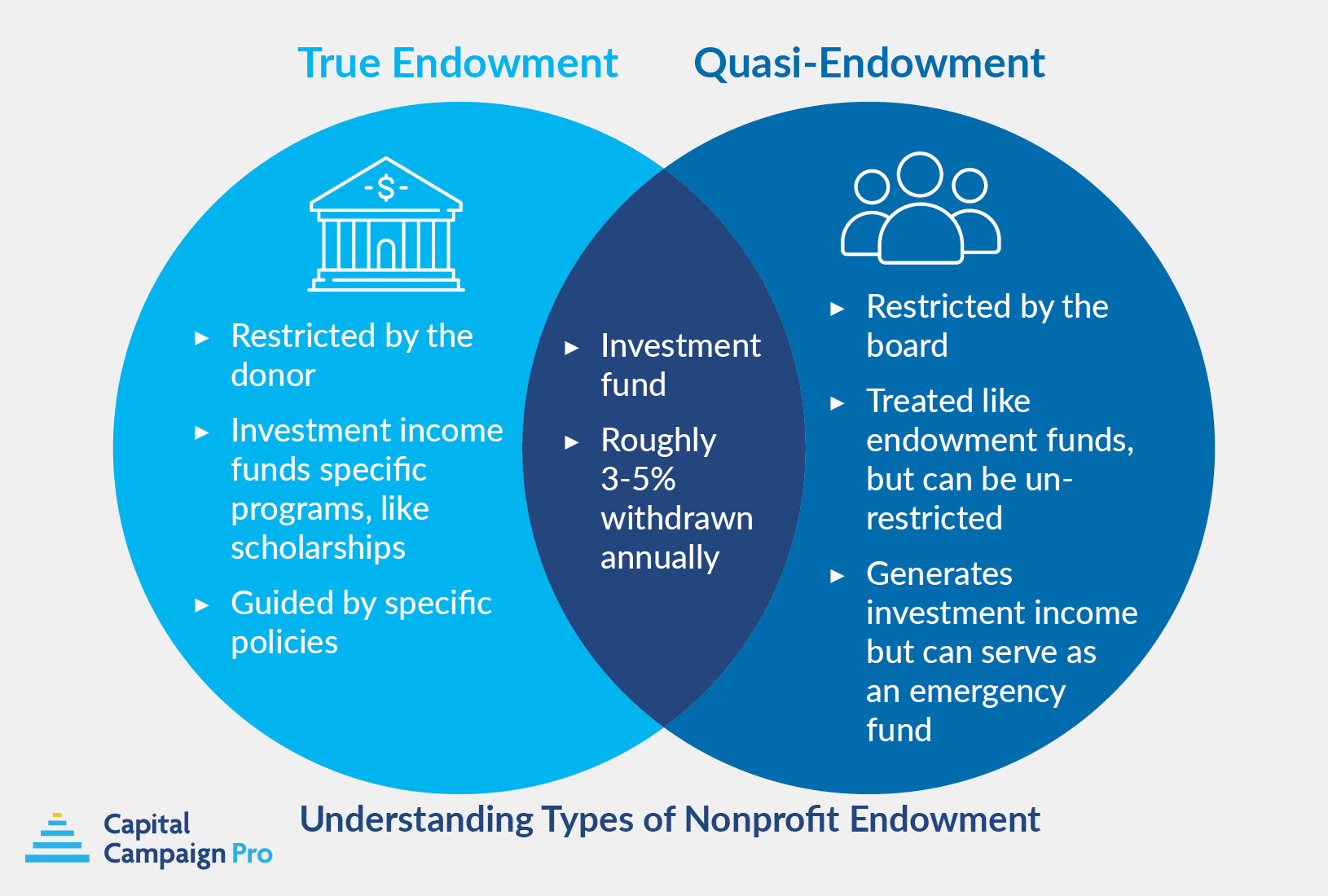

Organizations have two types of endowment funds:

True Endowment

True endowment funds are restricted by the terms of a donor’s gift.

Common endowment funds are, for example, scholarship funds. A donor will make a gift with the stipulation that the principle is to be invested and income from that investment must be given toward a scholarship. Colleges and universities usually have specific programs for such gifts with specific requirements about how much money someone needs to give to create a scholarship fund.

You might also see named faculty chairs or other specific items that are funded by donor-restricted endowment gifts. Those restricted endowment funds are guided by a set of specific policies that cover their investment and spending decisions.

But that’s not the end of the endowment story.

Quasi-Endowment

Many organizations have a board-restricted or “quasi” endowment account. Funds of that sort are treated as though they are endowment funds, but in actuality they are restricted by the board rather than the donor.

That means that the board could un-restrict some or all those funds should the situation require it. In other words, a quasi-endowment could be seen as a rainy day or emergency fund, in addition to generating revenue for the organization each year.

How They are Similar

The two types of endowment are the same in that the money put in the funds is invested and only a relatively small percent (usually 3-5%) is drawn out in any year to be spent on the mission of the organization. But to put it simply, true endowment is donor restricted and quasi-endowment is restricted by the board.

Many organizations have both true endowment and board-restricted quasi endowment funds. But if your organization is not a school or college, you should focus your attention on building a quasi (board-restricted) endowment rather than encouraging donors to restrict their gifts to specific uses.

The Best Way to Raise Funds for Your Endowment

Endowments are best raised through planned giving. Think about it this way:

Donors are usually motivated to give generously because of the immediate impact their gifts will make. However, endowment gifts have very limited impact.

A gift of $100,000 to renovate a building or provide startup funds for a new program appeal to donors because they can see the difference their money will make.

The same gift of $100,000 made to an endowment, has limited immediate impact. Depending on the spending policies, at 4%, a gift of that size may only result in $4,000 per year toward the immediate goals of the organization.

Most donors feel they can probably invest more effectively than nonprofit organizations and would prefer to give an annual gift and keep control of their invested assets rather than transferring them to a nonprofit to manage.

On the other hand, an estate gift can be seen as a way of perpetuating a donor’s generosity.

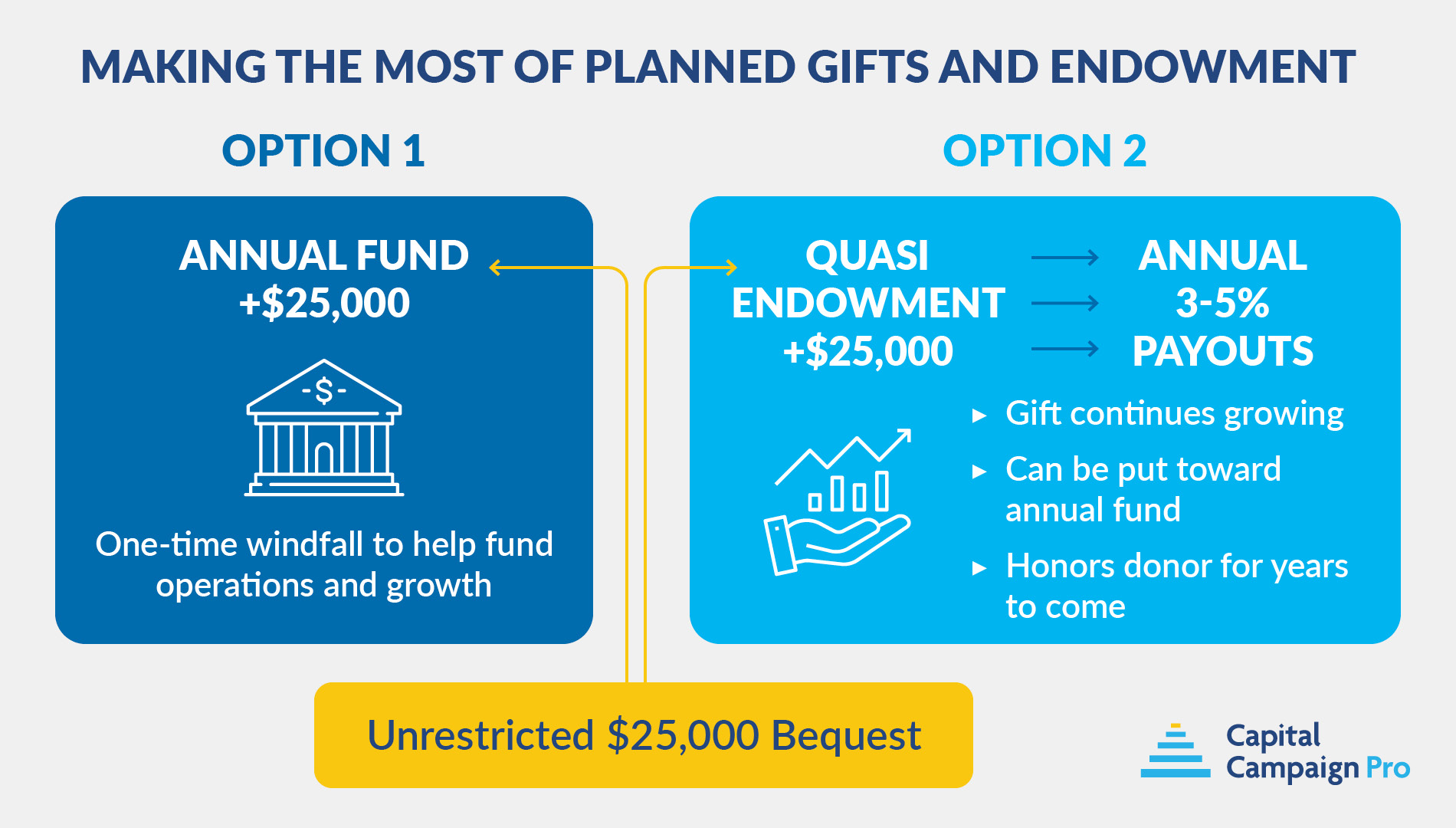

Imagine that Joanna Jones has been a loyal donor to your organization, giving to you annually for the last 20 years. Every year, like clockwork, Joanna sends $1,000 in response to your annual appeal. Then one day, you get a letter from an attorney telling you that Joanna has passed away and that she has left your organization $25,000 from her estate. The gift has no restrictions.

So when the money comes in, you have a choice:

- You can use Joanna’s estate gift as a windfall for your annual fundraising.

- Or, you can put it into your quasi-endowment fund and invest it so that every year, you can use the return on that investment for your annual fund.

If you were to take 4% (example only) of that fund for your annual fund you would, in essence, replace Joanna’s annual gift and keep her generous spirit alive for years to come.

Endowment Fundraising and Your Capital Campaign

It’s a bad idea to use a capital campaign primarily to raise money for your endowment. Capital campaigns are successful because they have well-defined short-term impacts. And, as you know, endowment does not.

However, you should consider including an endowment fund as one of the objectives of your capital campaign so you can use the campaign as an opportunity to encourage your donors to include your organization in their will.

Rather than setting a specific dollar goal for the endowment component of a campaign, you might define endowment goals for your campaign as a number of new or newly documented bequests you receive during the campaign.

It’s difficult to estimate accurately how much an estate gift will amount to, but the more estate gifts you get, the more your endowment will amount to over time. You can recognize donors to your campaign who provide documentation of a bequest intention, rather than at a specific gift level.

Unsure exactly how planned giving and endowment fundraising can best fit into your capital campaign? Chat with an expert today.

Understanding Planned Giving for Capital Campaigns

As you prepare for a capital campaign, you should make sure that you have the basics of a planned giving program in place.

Planned giving consists of donations made through a donor’s estate or financial plans. Bequests left in a donor’s will, trust, or estate plan comprise approximately 90% of planned gifts. They’re among the easiest planned gifts to set up, and they offer a high return on investment when secured—the online will platform FreeWill found that its average bequest is worth over $50,000.

1. Make sure you have the correct bequest language available and easily accessible to donors.

The most obvious place is to have bequest language on your website. Standard language can be found and used as a template on other nonprofit sites. However, be sure to have your attorney review the language before posting on your site.

You can also offer your donors tools that will notify you when new bequests are established. This is helpful because, in many cases, donors might not think to let you know that they’ve created, changed, or removed bequests in their wills.

2. Stock is another type of gift you should be able to easily accept for your campaign.

Work with your local financial institution to find out how to accept gifts of stock and sell them within 24 hours. You should have a policy to sell assets immediately. All you need to know is that donors should transfer appreciated stocks (those that have increased in value) directly to your organization.

Be aware that as stock gifts are processed through third-party brokers, they’re often reported to your nonprofit anonymously, making it difficult to attribute gifts and steward your donors. If you accept gifts of stock, have a plan in place for donors to notify you in advance to be ready to receive and liquidate them.

If donors have depreciated stocks (those that have decreased in value), they should sell them first and then send your organization a check. However, they should always check with their financial planner or accountant first for the latest tax policies and benefits before making any gift.

3. Identify resources in your community in the event a donor wants to make another type of planned gift.

For example, your local community foundation can help with Charitable Gift Annuities. The community foundation can also point you to other resource partners should you need them.

Grants from donor-advised funds have grown significantly in recent years and continue to set both contribution and payout records ($45.74 billion in 2021 payouts). If you already have experience with DAF gifts, you might incorporate them into your campaign plan. If not, start by asking your major donors and prospects if they have DAFs.

You do not need to be an expert in planned giving in order to accept planned gifts, especially if you focus primarily on bequests, which should take precedence because they’re accessible to more of your donors.

You do not need to be an expert in planned giving in order to accept planned gifts. Donors should use their own advisors including their own attorney, accountant, and financial planner.

Remember — your organization should not be providing legal or financial advice!

Final Thoughts

As you assess whether you’re ready for a capital campaign, make sure you have the basic elements of a planned giving program in place.

Ideally, you want to be able to use your capital campaign as an opportunity to speak with your donors about the possibility of making an estate gift. That will help grow your endowment in addition to current donor commitments to the more immediate aspects of your campaign.

Not sure how to begin laying out a fundraising strategy for your campaign? We can help. Capital Campaign Pro provides the resources, expertise, and coaching you need to develop a robust funding plan.

This is good and helpful, thanks. I am a consultant also and this is my strategy with all the campaigns I help plan and launch – solicit planned gifts in addition to capital pledges.